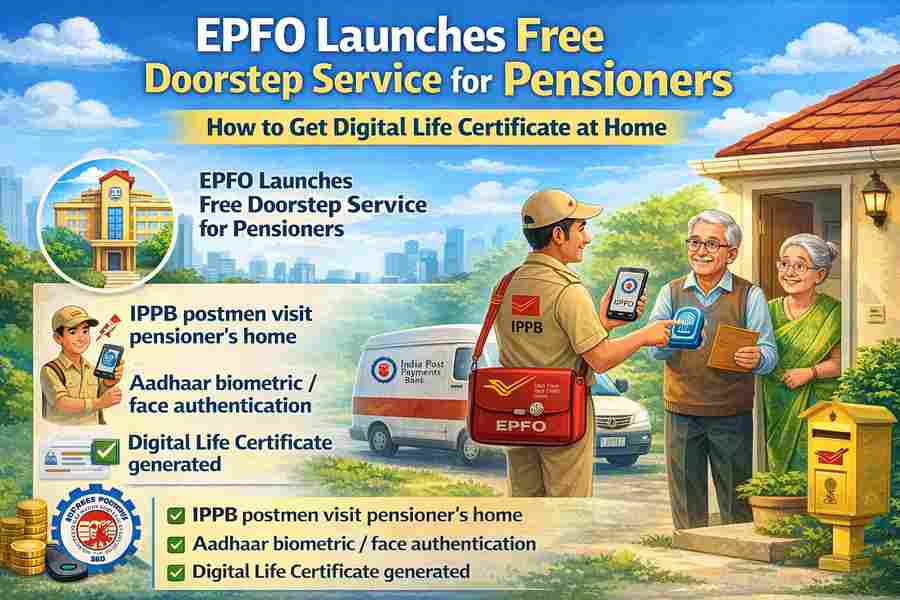

The Employees’ Provident Fund Organisation (EPFO) has introduced a helpful new initiative for pensioners under the Employees’ Pension Scheme (EPS). The organisation has launched a free doorstep service that allows pensioners to generate and submit their Digital Life Certificate (DLC) from home—without visiting a bank branch or EPFO office.

This new system is expected to reduce delays in pension payments and make annual verification easier, especially for senior citizens facing mobility or technology-related challenges.

What Is the New EPFO Doorstep Service?

Under this initiative, EPFO has partnered with India Post Payments Bank (IPPB) to provide home-based support for pension verification.

Postal workers (postmen) will visit eligible pensioners at their homes and complete the Digital Life Certificate process using:

✅ Aadhaar-based fingerprint authentication

✅ Face authentication (where applicable)

Once the authentication is successful, the postman generates the DLC on the spot, completing the pensioner’s annual “proof of life” requirement securely.

Why EPFO Started This Facility

Many pensioners face difficulties while submitting their annual life certificate due to:

- Advanced age and poor mobility

- Health conditions that restrict travel

- Remote location or lack of transport options

- Lack of smartphone access or digital knowledge

- Long waiting lines at banks or government offices

Since a missed life certificate submission can lead to pension interruptions, the doorstep service is aimed at ensuring no pension payment gets delayed due to procedural issues.

What Is a Digital Life Certificate (DLC)?

A Digital Life Certificate, also known as Jeevan Pramaan, is an electronic document that confirms a pensioner is alive and eligible to continue receiving a pension.

It is generated through Aadhaar-linked verification such as:

- Fingerprint scanning

- Facial recognition authentication

📌 Validity: Once generated, the Digital Life Certificate remains valid for one year.

Is the EPFO Doorstep DLC Service Chargeable?

No. The service is completely free for pensioners.

As per official information, the postman will generate and register the DLC without charging any fee. The cost of this service is handled by EPFO’s pension processing system.

✅ Pensioners do not need to pay for booking or doorstep verification.

How to Book a Home Visit for Digital Life Certificate

To request this free home service, a pensioner (or family member) can book a visit through IPPB.

Steps to book the visit:

- Call IPPB customer care

- Register a request for the doorstep DLC service

- Select a suitable date and time for the visit

- A postman will be assigned for the appointment

- Aadhaar verification will be done using biometric or face authentication

- The DLC will be generated and registered successfully

📌 Example:

If a pensioner lives in a remote area or cannot visit a bank due to health issues, a family member can request the service and the postman completes the process at home.

Key Benefits of This EPFO Service

This doorstep facility offers multiple advantages:

✅ Convenient for elderly pensioners

✅ No need to travel to banks or EPFO offices

✅ Prevents pension delays due to missed verification

✅ Secure Aadhaar-based authentication

✅ Completely free of cost

✅ Saves time and reduces stress

Final Thoughts

The EPFO doorstep service for pensioners is a strong step toward making pension processes easier and more accessible. With IPPB postmen visiting homes to generate Digital Life Certificates, pensioners can complete annual verification without the burden of travel or digital hassles.

This initiative is expected to support thousands of EPS pensioners and ensure pension payments continue smoothly without unnecessary interruption.