Selling a house, plot, or inherited property can feel like a financial win—until you realise a large portion of the profit may go towards capital gains tax.

The good news? India’s Income Tax Act offers multiple legal ways to reduce or even fully save capital gains tax, depending on what you sold and how you reinvest the profits.

This guide explains the latest rules in a simple way and covers the most useful exemptions under Section 54, 54F, 54EC, and more.

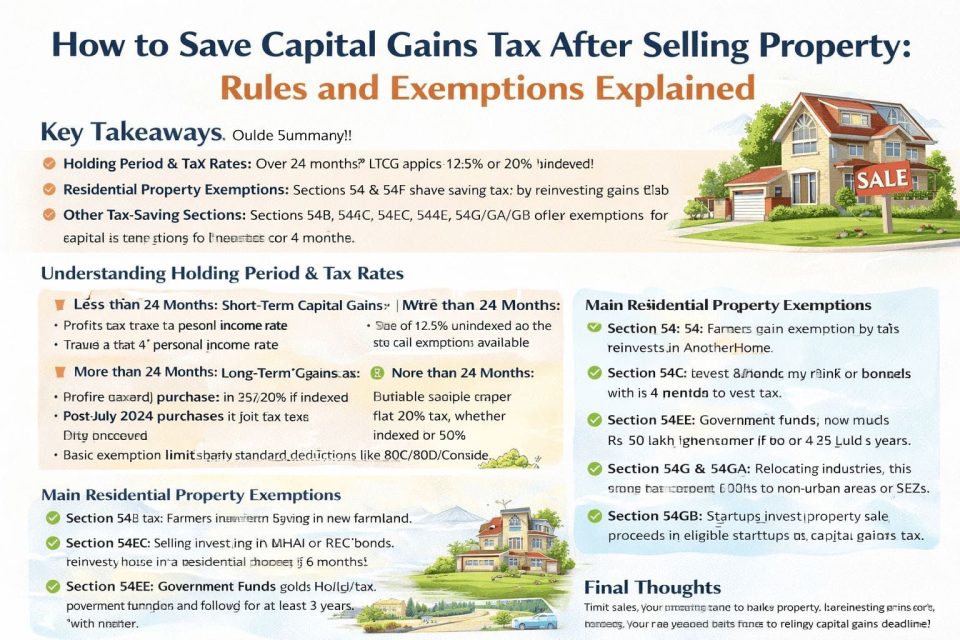

✅ Key Takeaways (Quick Summary)

- If you sell property after holding it for 24 months or more, the profit is usually treated as Long-Term Capital Gain (LTCG).

- LTCG on property is taxed at 12.5% or 20% (with indexation in eligible cases) depending on the purchase timeline and rules.

- If you sell before 24 months, gains become Short-Term Capital Gains (STCG) and are taxed as per your income slab.

- You can save tax using exemptions like:

- Section 54 / 54F (buy another house in India)

- Section 54EC (invest in bonds like NHAI/REC within 6 months)

- Special options for farmers, industries, and start-up investments

1) Understanding Capital Gains Tax on Property Sale

✅ Long-Term vs Short-Term (Most Important Rule)

✅ Long-Term Capital Gains (LTCG)

If you sell the property after 24 months, your gain becomes LTCG.

- Tax is generally charged at a fixed rate (not slab-based)

- You may get exemption options under various sections

✅ Short-Term Capital Gains (STCG)

If you sell the property within 24 months, your profit becomes STCG.

- STCG is added to your income

- Tax is charged as per your income slab rate

- Usually, there are no special exemptions like Section 54 for STCG

📌 Simple Example:

If you bought a flat in Jan 2023 and sell it in Dec 2024 (less than 24 months), the profit is STCG.

If you sell in Feb 2025 (more than 24 months), the profit becomes LTCG.

2) LTCG Tax Rates on Property Sale (Quick Overview)

If the property is held for more than 24 months, the tax rate is typically:

- 12.5% on plain LTCG OR

- 20% on indexed LTCG (indexation benefit may apply in eligible cases)

⚠️ Note: Tax rules may differ based on purchase date, asset type, and taxpayer category.

3) Can You Use the Basic Exemption Limit to Reduce Tax?

Yes, in some cases.

If your income is low (or you don’t have other income), you may adjust a part of LTCG against the basic exemption limit.

However:

✅ Basic exemption adjustment can help

❌ Deductions like 80C, 80D, etc. do not reduce LTCG tax directly

4) Best Ways to Save Capital Gains Tax After Selling Property

Here are the most practical and widely used exemptions.

✅ Section 54: Save Tax by Buying Another House

Who can use it?

People selling a residential house property

How it helps:

If you reinvest LTCG into another residential property in India, the capital gains may be fully or partially exempt.

📌 Common use case:

You sell an old apartment and purchase a new flat using the profits.

✅ Best for: homeowners upgrading or shifting cities

✅ Section 54F: Sell Another Asset and Buy a House

Who can use it?

Those selling any long-term asset other than a house (like land, shares, gold)

Condition:

You reinvest the gains into a residential house in India.

📌 Example:

You sell a plot or long-term shares and use the sale proceeds to buy a flat.

✅ Best for: investors converting asset profits into property

✅ Section 54EC: Invest in Bonds to Save Tax (NHAI/REC)

If you don’t want to buy another property immediately, this is one of the most popular alternatives.

How it works:

You can invest the capital gains into government-backed bonds, such as:

- NHAI bonds

- REC bonds

⏳ Must be invested within 6 months of sale.

✅ Best for: people who want low-risk tax-saving without buying real estate again

✅ Section 54B: For Farmers Selling Agricultural Land

If agricultural land is sold and the money is used to buy new farmland, capital gains tax may be waived under this section.

✅ Best for: farmers reinvesting into agricultural assets

✅ Sections 54G / 54GA: Shifting Industrial Units

These exemptions are designed for businesses relocating operations:

- From urban to non-urban areas

- Into Special Economic Zones (SEZs)

✅ Best for: industrial units planning relocation

✅ Section 54GB: Invest in Eligible Start-Ups (Individuals/HUF)

This section allows exemption if property sale proceeds are invested into eligible start-up companies under specified conditions.

✅ Best for: founders and investors reinvesting into start-up ventures

✅ Section 54EE: Invest Gains into Government-Approved Funds

This option offers exemption when gains are invested in government-notified funds (up to a limit).

✅ Best for: long-term investment-based tax planning

5) Quick Checklist Before You Plan Tax Saving

Before applying for any exemption, confirm:

✅ Your asset qualifies as LTCG (24+ months holding)

✅ You know the correct exemption section (54 / 54F / 54EC etc.)

✅ You meet the deadline rules (purchase time, bond investment window)

✅ Your documentation is ready (sale deed, purchase deed, bank proof)

Final Thoughts

Capital gains tax after selling property can look intimidating—but if you plan early, it’s very possible to save tax legally.

The best option depends on your goal:

- Want another home? → Section 54 / 54F

- Don’t want to buy property again? → Section 54EC bonds

- Farmer or business owner? → 54B / 54G / 54GA

- Investing in start-ups? → 54GB

A little planning before the sale (or immediately after it) can save you lakhs in tax.