Save Lakhs in Taxes: Why Every Indian Family Should Form a HUF Today

What is a Hindu Undivided Family (HUF)?

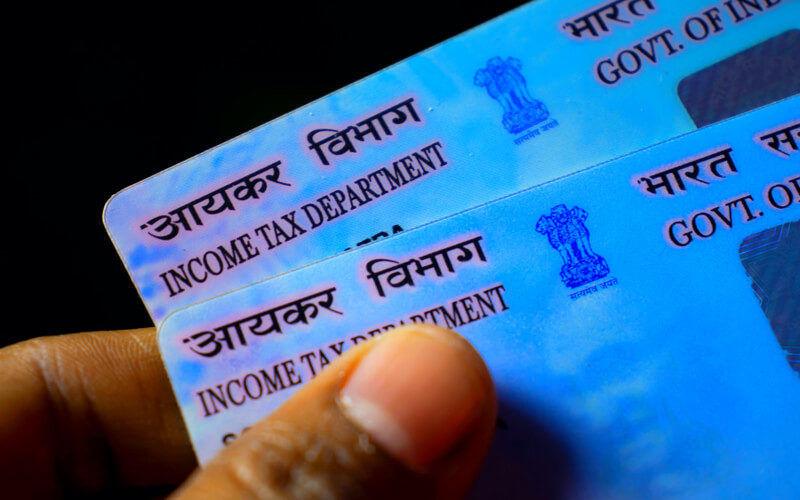

A Hindu Undivided Family (HUF) is a legal entity under Indian tax laws. It helps families save taxes by pooling their assets under one umbrella. A HUF has its own PAN card and files a separate tax return.

Did You Know? Some HUFs in India have existed for over 100 years, passing tax benefits through generations!

Tax Benefits of a HUF

HUFs enjoy several tax benefits that reduce the overall tax burden.

| Tax Benefit | Impact |

|---|---|

| Separate PAN for HUF | Reduces individual tax liability |

| ₹2.5 lakh exemption | Saves up to ₹50,000 in taxes annually |

| Additional 80C benefits | Claim deductions twice (₹1.5 lakh each) |

| Rental income transfer | Prevents individuals from entering higher tax slabs |

| Business income sharing | Distributes profit among family members |

How to Create a HUF

- Draft a HUF deed mentioning family members and Karta.

- Apply for a separate PAN card for the HUF.

- Open a bank account in the HUF’s name.

- Transfer assets or invest under the HUF for tax benefits.

Who Should Consider a HUF?

- Families with rental income.

- Business owners wanting to split profits.

- Individuals in higher tax slabs.

- Families with ancestral property.

A HUF is an excellent way to save taxes and manage wealth efficiently. If you qualify, forming a HUF can be a game-changer for your family’s financial future!